Cheque bounce cases are among the most frequently litigated financial offences in India. Governed by Section 138 of the Negotiable Instruments Act, 1881 (NI Act), these matters arise when a cheque issued for repayment of debt or settlement of dues is dishonoured by the bank. What was once a civil default now has serious criminal consequences, including imprisonment and fines.

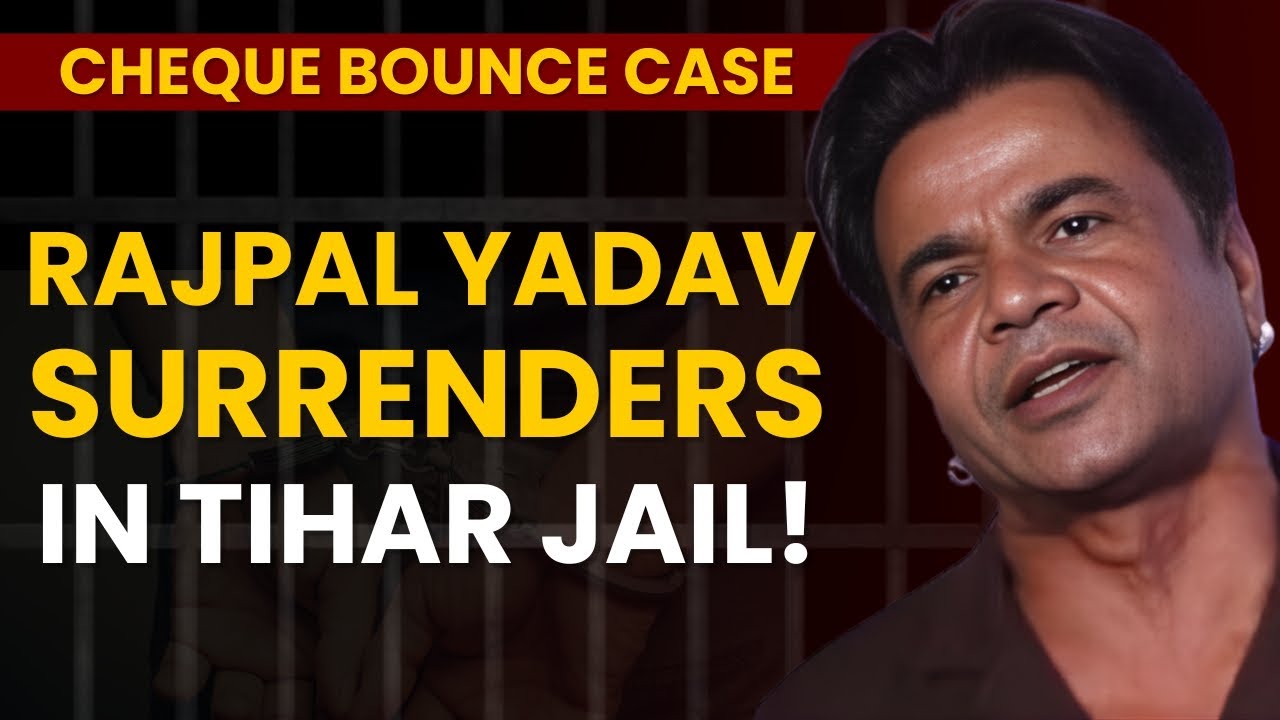

Recently, the cheque bounce matter involving Bollywood actor Rajpal Yadav has brought fresh public attention to Section 138 cases, with major news outlets reporting on the Delhi High Court’s strict judicial response. This blog explains how cheque bounce cases work under the NI Act, what legal procedure applies, possible penalties, and what the Rajpal Yadav news signifies for legal compliance in India.

What Is a Cheque Bounce Case Under the NI Act?

A cheque bounce case under Section 138 arises when a cheque is issued against a valid debt but gets dishonoured by the bank due to reasons such as insufficient funds, closure of account, or signature mismatch. When this happens, the recipient (payee) can pursue criminal prosecution against the drawer of the cheque.

Key Conditions Under Section 138

-

The cheque must be drawn on a valid bank account which exists at the time of issue.

-

The cheque must be presented within the validity period (usually three months).

-

The bank must return the cheque unpaid with a proper return memo.

-

The payee must serve a legal notice within 30 days from receiving the return memo demanding payment of the cheque amount.

-

If the drawer fails to pay within 15 days after service of the demand notice, the payee is entitled to file a complaint in court within 30 days from the date of expiry of the 15‑day period.

If any procedural step is missed, the complaint can be dismissed by the court due to technical non‑compliance. Professional legal guidance ensures that these timelines are met scrupulously.

Penalties and Legal Consequences

Once a complaint under Section 138 NI Act is filed and admitted:

-

The court can issue a summons to the accused.

-

On conviction, penalties may include:

-

Imprisonment for up to 2 years, and/or

-

Fine which may extend to twice the cheque amount. These limits are statutory and cannot be exceeded by the court.

-

-

Courts may also award compensation to the complainant equivalent to the cheque amount.

It is possible to pursue civil remedies concurrently, such as filing a separate recovery suit. However, Section 138 specifically facilitates summary criminal proceedings, designed for faster adjudication compared to traditional criminal trials.

The Significance of Cheque Bounce Laws

Cheque bounce provisions serve important purposes:

-

Financial Discipline: They ensure that negotiable instruments are honoured, protecting economic confidence.

-

Creditor Protection: They provide a statutory mechanism to pursue creditors for recovery.

-

Deterrence: Criminal sanctions deter frivolous issuance of cheques without sufficient funds.

-

Trust in Commerce: Businesses depend on negotiable instruments for transactions, and legal enforcement under Section 138 safeguards commercial trust.

Recent High‑Profile Example: Rajpal Yadav and Cheque Bounce Litigation

In a case that has drawn significant media coverage, Bollywood actor Rajpal Yadav was directed by the Delhi High Court to surrender to jail authorities in connection with his conviction in multiple cheque bounce cases. According to reports published by NDTV, the court refused to recall its surrender order despite a plea from Yadav’s counsel, emphasizing that it cannot grant “special circumstances” based on an individual’s profession or background.

The news outlines that:

-

The Delhi High Court refused to recall its directive for Rajpal Yadav to surrender after several instances of failure to comply with court timelines.

-

Yadav’s counsel had sought additional time to arrange funds to repay the complainant, M/s Murali Projects Pvt Ltd, but the court observed that continued non‑compliance reflected a lack of respect for legal orders.

-

The case traces back to multiple dishonoured cheques and the obligation to repay large sums, with partial deposits already made while substantial amounts remained outstanding.

Further reports confirm that Yadav was ordered to surrender by February 4, and later appeared before jail authorities after the court refused relief, citing repeated breaches of undertakings as the reason.

Why the Rajpal Yadav Update Matters for Cheque Bounce Law

This high‑profile case reinforces several key legal principles relevant to cheque bounce litigation:

Strict Compliance With Court Orders

Courts expect orderly compliance with directions. Repeated breaches of undertakings can prompt stricter enforcement, including imprisonment — a crucial reminder for both individuals and businesses.

No Special Treatment

Judicial pronouncements in this case stress that courts will not favor individuals due to their profession or public stature when statutory obligations are not met.

Enforcement of Monetary Obligations

Section 138 is aimed at ensuring that negotiated instruments are treated with legal seriousness. Cases like this demonstrate how default and delay can escalate into criminal liability.

Common Challenges in Cheque Bounce Cases

Litigants often encounter procedural and substantive challenges:

-

Missing statutory notice deadlines can lead to dismissal.

-

Technical bank errors may be invoked as defences.

-

Evidence such as bank return memos, notice receipts, and proof of service must be presented meticulously.

-

Negotiations for settlement while a criminal case is pending can be complex and require legal assistance.

Professional counsel helps in navigating all these requirements effectively.

How Legal Experts Support Cheque Bounce Matters

Experienced lawyers assist clients by:

-

Ensuring strict procedural compliance.

-

Drafting and serving statutory demand notices correctly.

-

Representing clients in criminal courts on merits.

-

Advising on concurrent civil recovery actions.

-

Handling settlement negotiations where appropriate.

Legal strategy and attention to procedural detail are critical in securing favourable outcomes.

Conclusion

Cheque bounce cases under Section 138 of the NI Act remain a powerful legal tool to enforce financial accountability in commercial and personal transactions. They carry both criminal sanctions and financial penalties, making compliance essential.

The recent developments in the Rajpal Yadav cheque bounce case, as covered by major outlets like NDTV and national legal reporting, highlight that the Indian judiciary treats these matters with seriousness and expects complete adherence to legal mandates.

For individuals and businesses dealing with cheque dishonours, understanding the statutory framework and engaging experienced legal assistance is vital to protect rights and enforce obligations under the law.

References

-

NDTV – “Court rejects actor Rajpal Yadav’s plea to recall surrender order in cheque bounce case” – Link

-

Indian Express – “Rajpal Yadav surrenders to Tihar Jail in cheque bounce case” – Link

Note: Information and updates regarding the Rajpal Yadav cheque bounce case have been sourced from these verified news outlets.